Appeared in 2009, bitcoin is still an enigma for a large number of investors. How to classify it? How is the bitcoin value

Bitcoin, like all other

This article will give you many keys to better understand what these new ecosystems really are. We will also try to explain how they work and existing theories at the moment to try to value it.

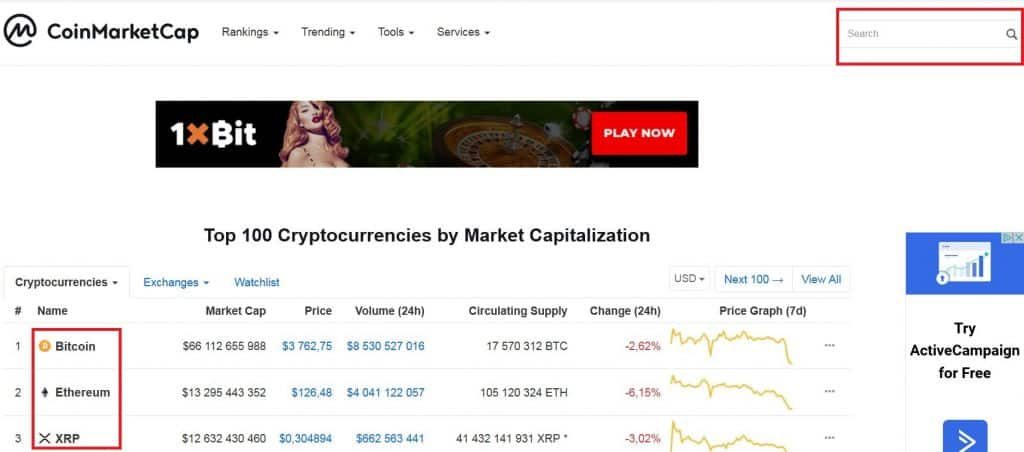

Where to find the bitcoin value in Dollar?

It is essential to begin by clarifying how the value of the bitcoin is represented. It is always determined by national currencies or

The price of bitcoin is constantly changing and results from the confrontation between supply and demand in the cryptocurrency market. In other words, the price of bitcoin at a « T » time is what sellers and buyers are willing to accept for their bitcoins.

The history of all these prices is usually represented on a graph with the date on the abscissa and the price on the y-axis.

Value of Bitcoin in dollar

The price of bitcoin in

However, this application only offers the price of bitcoin. If you are interested in the price of other cryptocurrencies, you can visit Coinmarketcap.

Bitcoin price live

The

You will thus be able to chart as well as many tools of technical analysis.

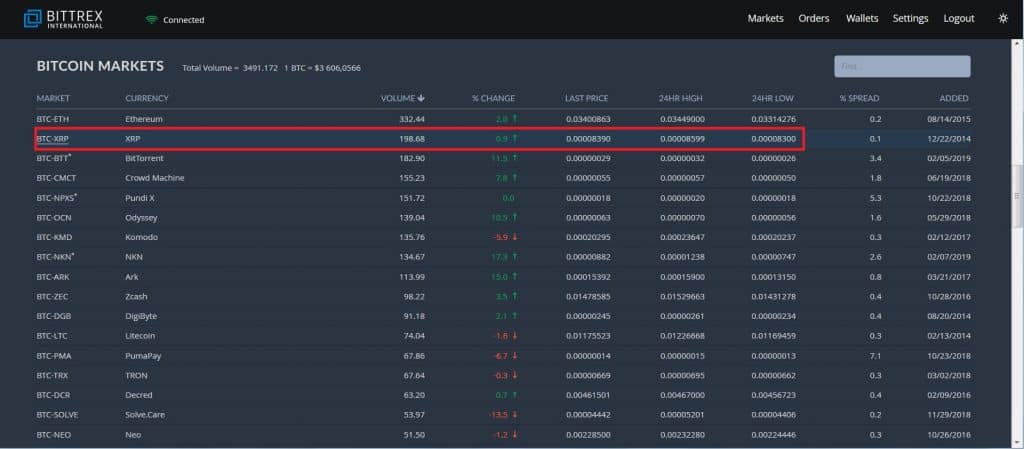

Bitcoin value against other cryptocurrencies

If you are looking for the value of bitcoin against other crypto-currencies, then you have an advanced level. The best place to find them is on crypto exchanges, where supply and demand meet. It is indeed on these exchanges that you can find all these pairs. But not all exchanges offer an important number of pairs. Crypto / Crypto exchanges, on which it is only possible to deposit crypto-currencies, generally count much more.

Indeed, exchanges like Bittrex or

As you can see on the page below, Bittrex offers many Bitcoin / Cryptocurrency peers:

What is bitcoin?

Before describing the elements that impact the bitcoin price, it is essential to determine what bitcoin is. There has been much debate in recent years to clarify whether bitcoin is a currency, a financial security or a commodity.

To answer this question, we must first better understand the structure of the bitcoin network.

Bitcoin is a network and a coin

The word bitcoin defines both the network of bitcoin users and the token that is exchanged between these users. The bitcoin network consists of a large number of user members connected to each other by their computers. The purpose of this network is only to exchange value between its members, thanks to bitcoin tokens.

veryone can become a member of this network. If a user wants to interact directly with the network he will download the bitcoin protocol on his computer by downloading the bitcoin source portfolio. It is also possible to take part in the bitcoin network through an intermediary, such as an exchange. You can also interact with the bitcoin network without downloading the protocol. That’s what you do when you buy your bitcoins on a cryptocurrency exchange.

[Bitcoin protocol: The bitcoin protocol is the source code of the bitcoin. It is an open source computer program, that is to say accessible to all. This program provides all the operating rules of the bitcoin network: creation of transactions, mechanism of mining, interaction between members. For simplicity, the bitcoin protocol contains all the rules to tell your computer how to join the bitcoin network].

All transactions are then added to the blockchain. The blockchain is a decentralized database that is updated by miners. Miners are therefore the bankers of the bitcoin network since they are the ones who update the « accounts » of the network recorded on the blockchain. The big innovation is that the update of the account is no longer done by a trusted tier (bankers for example), but directly by members of the network (the miners).

What is important to remember is that bitcoin is a decentralized network of computers, which perform transactions with each other using bitcoin. All these transactions are then stored in a blockchain chronologically.

Is bitcoin a currency?

Really sorry, but the answer is both yes and no.

First, bitcoin shares many features with traditional currencies. Bitcoin is indeed a unit of account. That is, it can be used to measure the value of another good. Then bitcoin is used to exchange value. As we have done this exchange of value is between the members of the network or those who use an intermediary as a stock exchange. Finally,

Yet bitcoin is not a currency in the same way as the Euro for example. First of all, bitcoin does not have a « legal tender ». In other words, not all economic actors are obliged to accept euros. Although more and more merchants are accepting payments in bitcoin, you can not force those who do not want it.

Another important difference is that the euro is a currency managed by a central bank. In other words, monetary policies related to the euro and its volume are managed centrally. This is not the case for bitcoin as we have seen previously. Indeed, bitcoin is based on a decentralized technology (blockchain), so its management is subject to the permanent consensus of its users.

Finally, bitcoin is not yet regulated, unlike national currencies. That’s why if you lose your bitcoin no regulation can protect you. This is not the case if you steal your credit card since your bank will theoretically compensate you.

Bitcoin and crypto-currencies in general represent an important advance in that they allow the exchange of value directly on the Internet between people who do not know each other. Until today, we always had to go through an intermediary (bank or credit card company). This freedom comes at a price since bitcoin holders are fully responsible for their conservation.

Is bitcoin a financial Security?

Like traditional financial securities, the value of bitcoin is determined by the market. It is therefore legitimate to wonder if bitcoin and other cryptocurrencies cannot be qualified as traditional financial securities.

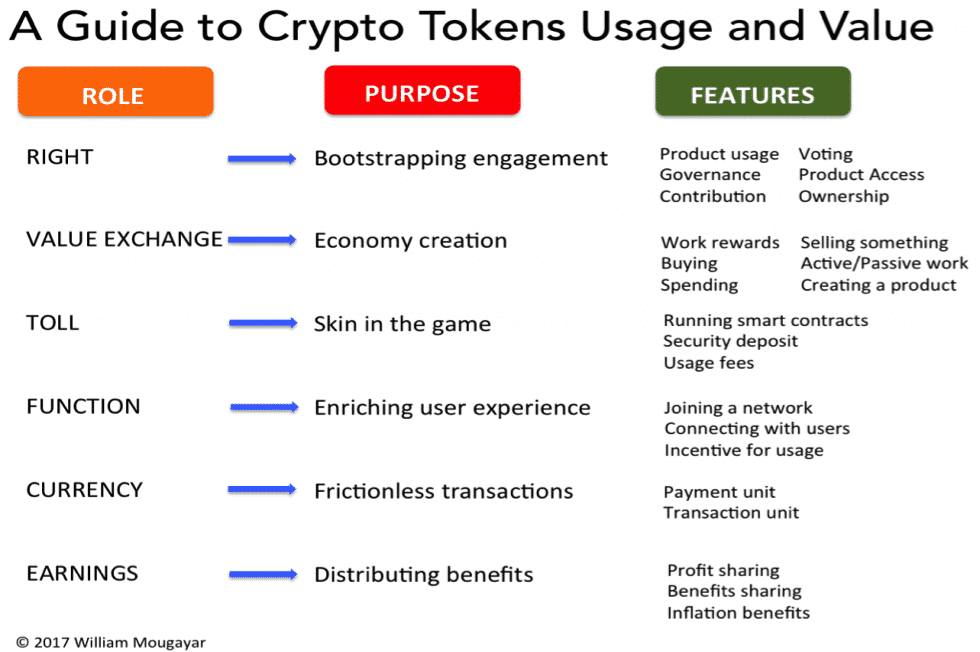

The answer to this question must be balanced. Indeed the role played by a token in the network that created it is not always the same. The main role of tokens is to transfer value between members of the network, as does bitcoin. But in other applications, tokens can have different or additional functions. In the « Utility Tokens » for example, are qualified thus by that they can have very different functions.

William Mougayar is also one of the first to have listed the roles that can have tokens.

You may be wondering what the regulators’ position is on this issue. Many of them have not yet pronounced. In France, it has been admitted that tokens are not financial securities. That’s why a full-fledged

The American Stock Exchange regulator, the Security and Exchange Commission (« SEC »), submits the tokens to the « Howey Test ». The Howey Test determines that a token represents an investment contract if

« a person invests his money in a joint venture and is expected to expect profits solely from the efforts of the sponsor or a third party ».

Certain token fulfills these conditions when for example they produce dividends for their holders. Numerous

However, SEC chairman Jay Clayton confirmed in a statement released in late December 2018 that bitcoin is not an investment contract and as such is not subject to current regulations.

Is bitcoin a commodity?

What is a commodity?

A commodity could be defined as a unit of a tangible asset or not. This asset can be alive like livestock, cereals or not such as coal, gold, gas or electricity. Unlike other financial stocks such as stocks or bonds, it does not matter who produces the commodity. Indeed, the action of a company A can never be valued in the same way as the action of a company B.

On the other hand, a commodity is by definition fungible. This means that one gram of gold can be replaced by any other gram of gold provided both are of the same nature and quality. In other words, the price of a commodity is almost solely determined by a confrontation between supply and demand on the market. It does not have any value in itself that can influence the way its price is determined. That means you have to sell it to make money with it.

This first definition seems to perfectly stick with what is bitcoin. A fungible intangible asset that must be produced and has no intrinsic value, which implies that the price is solely determined by the market. Indeed, as for gold or coal, the production of bitcoin has a cost. The term used for the production of bitcoin is also the same since we are talking about « mining » bitcoin. Miners are network members whose mission is to produce bitcoins.

The cost of mining

It is important to understand that the mining of bitcoin is a business for miners. Indeed, they compete with each other to add blocks to the bitcoin blockchain. The first miner who solves the mechanism of the « Proof of work », is indeed the one who can add the block to the blockchain. The « Proof of Work » can be compared to a problem that miners must solve.

But to be able to participate in the « Proof of Work » mechanism, you need very specific and expensive equipments. Added to this is the cost of internet connection and electricity. Miners must

It is also important to remember that the difficulty of the « Proof of Work » increases with the number of miners involved in the mining mechanism.

Some analysts have estimated that bitcoin can be considered a commodity because of its cost of production (or « extraction »). Like gold, the creation of bitcoins generates significant costs. It is in this sense that the other

Now, there is no evidence that this cost of mining impacts the evolution of bitcoin prices. On the other hand, the opposite is much clearer. Indeed, the price of bitcoin directly impacts the mining industry. Many miners have invested in hardware at the time when bitcoin was worth USD 20,000 and end up in 2019 with a very different profitability. Bankruptcies in the mining industry are so overwhelming that some wonder if bitcoin can survive at too low prices.

The future will tell, but in theory yes, since the protocol adapts to the number of miners (« Hashing power ») present on the network.

What is the real value of bitcoin: the elements to take into account

In this section, we will go into the details of what makes or contributes to the value of bitcoin. In fact, many factors influence the price of bitcoin and we will try to list them below. As mentioned above, the price of bitcoin is the result of the confrontation of supply and demand on the capital markets. So what drives people to want to buy bitcoins?

The service rendered by the network

First, the bitcoin network renders service efficiently to its members. As we have seen, bitcoin is a decentralized and autonomous network made up of all computers that have downloaded the bitcoin protocol. But the initial goal of this network is to solve a very specific problem. That of the transfer of value on the internet.

The transfer of value on the internet

This is one of the great contributions of blockchain technology. To illustrate, take the example of the transfer of a video on the internet. At the moment when you transfer a video on the

But using bitcoin, you can now transfer the 20 euros directly to a stranger via the internet and without an intermediary. This is the service bitcoin provides. It makes it all the better that the transfer is immediate and almost free whatever the country of the recipient and the volume of the transfer.

Each cryptocurrency solves a very particular problem

Each cryptocurrency available today has set itself to solve a very particular problem. There are thousands of them, so there are thousands of problems that need to be solved through these decentralized exchanges. The tokens issued by these crypto-currencies are only the means necessary to solve the problem. Bitcoin is only the means to allow the transfer of value. But it is nothing without the protocol, the network of programmers, miners, users, the blockchain and all the other constitutive elements of these crypto-currencies.

WHAT IT SHOULD BE UNDERSTANDING IS THAT IN THEORY, THE VALUE OF THE TOKENS DEPENDS ON THE NETWORK’S CAPACITY TO SOLVE THE PROBLEM IT SET FORWARD. IF THE SOLUTION PROPOSED BY THE NETWORK WORKS AND IF IT IS PERCEIVED BY INVESTORS THERE WILL BE A REQUEST FOR TOKEN.

The number of tokens issued

The case of bitcoin: a non-inflationary cryptocurrency

Unlike national currencies that can be produced without limits, the number of bitcoins is limited. The bitcoin protocol provides for the maximum number of bitcoins that can be issued. This figure is 21 million.

As you may know, bitcoins are emitted through the mechanism of mining. Indeed, each time a block is added to the blockchain by a miner, 12.5 bitcoins

At this rate, it is estimated that all bitcoins will have been mined by 2022. Bitcoin is therefore not an inflationary currency, which directly impacts its valuation. The fact that the total number of bitcoins that will be issued is already known leads to a feeling of scarcity in the face of the growing demand for this cryptocurrency.

This feeling is accentuated by the fact that bitcoin is often perceived as a « store of value ». Remember that

The number of tokens issued

It is also important to note that the number of tokens issued by a project, directly impacts its volatility. The price of a token will rapidly increase or decrease if the project has issued 100,000,000 tokens or less. It’s different from a billion chips.

Ripple, for example, has several billions of tokens in circulation. If a large number of investors decide to withdraw their chips at the same time the price will only be slightly impacted. Obviously, the opposite is also true.

For these reasons, it is generally considered that cryptocurrencies with more than 1 billion chips are less risky. It should be kept in mind that the gains are proportional to the risks taken by the investor. Crypto-currencies emit a large number of chips offering a more progressive return. This does not mean that performance cannot be important. An XRP (tokens issued by Ripple) went from $ 0.01 in 2016 to $ 3 in 2018, a price multiplied by 300.

A cryptocurrency with a number of token in circulation between 100 million and 1 billion, presents a moderate risk. Below 100 million, the risk and volatility are as old.

In summary:

| Number of Tokens | Risks and return on investment |

| Above 1 000 000 000 | Not high |

| Between 100 000 000 and 1 000 000 000 | Limited – the best balance is around 500 000 000 |

| Below 100 000 000 | High |

Price manipulation

If the decentralized network does not have any objective or tries to solve any particular problem, then the token emitted by this network can not theoretically have any value.

The only explanation for valuing in these circumstances would be price manipulation.

Crypto market is still unregulated and for this reason, are the prey of many course manipulations.

The best known is that carried out by the most important investors. Also called « whales » (or whales), it is not uncommon to see these investors massively buy the tokens of a network to raise the price artificially. Once the price is inflated, they abruptly down all their tokens, thereby dropping the price of the token.

All small investors attracted by the rising price and the buzz that accompanies it, is usually found with a worthless token. These operations are often called « Pump & Dump ». These manipulations are usually very well orchestrated. They are accompanied by a promotion campaign on forums lead by people paid by the Whales or simply informed by the latter.

Indeed, knowing in advance that the tokens will be the subject of a « Pump » is the insurance of quick returns. In addition to the manipulation of the courts, there is an insider’s offense or at least a complicity in manipulation.

All these manipulations have largely contributed to the instability of the prices of crypto-currencies in recent years and to their important volatility. It is important to note that on regulated markets, all these acts are penalized.

This type of manipulation obviously occurs without taking into consideration the real value of the network. This real value can only be obtained by carrying out a thorough analysis of the project that interests us.

Token Valuation Theories

Several methods or theories have been proposed to try to determine the current or future value of bitcoin and crypto-currencies in general. We will focus here on the two best-known models. You can also check out models developed by Vitalik Buterin, Brett Winton, and Percy Venegas.

The Network Value to Transaction (NVT Ratio)

Imagined by Willy Woo, the NVT ratio could be compared to the Price / Earning ratio which is a classic business analysis tool. Willy Woo describes it in this way:

« We did not know how to value Internet securities in the 1990s. The P / E ratios were at their peak and people did not understand the zero marginal cost of businesses. … In Bitcoin, we know the flow of the transaction, but we do not know its income, because it is not a company. It’s the closest proxy we have. That’s all it really is. If Bitcoin was a payment company, measure its debt to its value. «

NVT = Network Value / Daily Transaction Value

You can find this information on blockchain.info. The « Network Value » is what we also call the market capitalization of the bitcoin network at a given moment. This is the dollar value (or any other currency) of all bitcoins. The « Daily Transaction Value » as its name indicates is the amount (always in national currency) exchanged during the last 24 hours.

Divide the first by the second and you get the « Network Value to Transaction ratio ». The NVT Ratio is based on the idea that we can use money flowing through the network as a proxy for network evaluation.

As Willy Woo says on his blog:

« When the Bitcoin NVT is high, it indicates that the value of its network exceeds the value transmitted on its payment network. This can happen when the network experiences high growth and investors value it as a high yield investment, or when the price is in a bubble. «

Clearly, the higher the NVT, the more it indicates that the value of the bitcoin is superficial and a correction is probably close. The opposite is also true. If the NVT is too low, a reversal of trend could be expected. It is one of many tools that we mention because it allows us to anticipate changes in trends.

It determines whether the price of a token is underestimated or over-valued, but not to predict its exact value.

« Equation of exchange » (Token economy)

Developed by Chris Burnisk, this theory uses the same equation used to value traditional currencies. Chris Burnisk is indeed the first to have proposed to use the Equation of Exchange.

The equation is presented in the following way: M x V = P x Q

where

M = the total value of the tokens

V = the velocity of the tokens, that is to say the number of times they have been traded over a given period.

P = in the case of cryptocurrencies, P represents the price of resources monetized by the network represented in $ / GB.

Q = total resources used by the network.

We could take the example of SIA COIN, a project based on the Ethereum blockchain. The purpose of SIA and to share the unused memory space of the members of the computer of the network. In other words, information belonging to members of the network could be stored in the memory of the computers of other members of the network.

In the case of SIA, to find « P » it will be necessary to determine the price in dollars of Gigabites of storage available on the network, represented in $ / GB. « Q » will represent the number of Gigabites available on the network.

If we multiply P and Q (where P = $ / GB and Q = GB), we get an amount in $. PQ represents the exchange of value in the ecosystem. It is in a way the Gross Domestic Product (« GDP ») of the micro-economy created by the protocol and the network. But this GDP is recorded on the blockchain.

Now that we know the value « PQ », we must determine the velocity of the tokens on the network to be able to deduce « M ». Indeed M = PQ / V.

Once we know « M », we can divide it by the set of tokens issued by the network and thus obtain the value of a token. To forecast the evolution of this value it is necessary to replace these data over several years.

As you can imagine all these data are relatively subjective. That’s why Chris Burnisk often recalls that he uses this method as an indicator rather than a foolproof instrument.

A general introduction on blockchain

[…] Bitcoin Value in Dollar – how to analyze and predict it? […]

Les commentaires sont fermés.