OVERVIEW

Name of the project: Bitshares

Launch date: 05 Nove 2014 form a fork of the bitcoin blockchain

Website: http://www.bitsharesfcx.com/homepage.php

Documentation : http://docs.bitshares.org/_downloads/bitshares-general.pdf

Token code: BTS

Total number of tokens : http://cryptofresh.com/assets

Marketcap : https://coinmarketcap.com/currencies/bitshares/

PRESENTATION

PITCH

Bitshares is both a decentralised excahge and a platform tailored to develop “Decentralised Autonomous Organisations Companies (“DAC”). In fact the exchange is the first DAC that has been developped.

– DECENTRALISED AUTONOMOUS COMPANIES

As you may guess from its name, a DAC is company with a decentalised functioning and managed by a software. This type of software is normally able to work without any human input and is autonomous.

This is also the case of the Decentalised Autonomous Organisation (“DAO”) developped by Ethereum. Despite its first setbacks, the DAO is revolutionnary in that allows human organisations to be managed in a decentralised manner and not only transactions as it is the case with the bitcoin. The DAO is actually a system of smart contracts which could work autonomously ifthey were programmed to do so, but in the case of the DAO some of these contracts are actioned by humans.

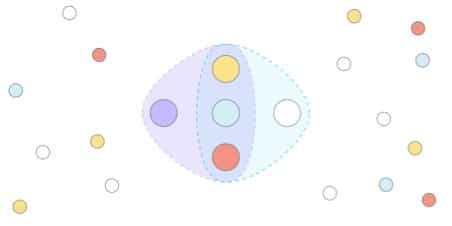

Bitshare is the first platform to function as a DAC through an elction process of Delegates and Witness who are in charge of implementing the system. Delegates mission is to make sure that the protocol is always up to date and improve it where it is possible. On the other hand, Witnesses validate all the transactions and add them to the blockchain. They are all on a list which is submitted on a pre-scheduled timeframe to the vote of Bitshares Shareholders, i.e any person thqt holds BTS. This consensus system is called Delegated Proof of Stake”, because the power is delegated but each shareholder influence on the network is proportional to its stake. In other words, the more BTS you detail, the most weight your vote will have.

– A DECENTRALISED EXCHANGE

The exchange platform Bitshares (intially called Bitshares X) is the first DAC to see the light of the day. one of the main innovation is to propose an exchange that is fully decentralised. Most of the existing exchanges rely on a centralised management of the funds and coins that transit or remain on them. Even if most of these exchanges pretend to keep all their customers’s keeys in “Cold Storage”, an important risk remain. In terms of security, Bitshares model is interesting because it delegates to each of its membres the responsability of the security of its own tokens. The concetration of all tokens in a centralised exchange allows attaquants to focus all their efforts on a single system, which is not case when they have to face as many systems as there are shareholders. In itself, decentralisation could well be the best defense against attaquant, even when the systems of each shareholders is poolry defended. It is also important to flag that due to this decentralised organisation, the identity of each shareholders is also protected.

Two additional features that worth mentionning, are first that Bitshares does impose restrictions on the amount of your transactions or on withdrawals. For instance, where most exchanges normaly apply a fee which is a percentage of the notional of your trade, Bistshares applies a fixed rate whatever the size of your trade.

– SMARTCOINS

On Bitshares, it is possible for anybody who has created its DAC, to issue the tockens of this company and sell them on the exchange. This is a very interesting way to organise a decentralised crowedfunding campagn or ICO.

It is also possible to buy and sell SmartCoins which are cryptocurrencies with a value that is correlated to the value of an underlying asset. For instance BitUSD is a smartcoin which value is linked to the value of the USD. In other words, the price of a BitUSD may fluctuate depending on the offer and demand as would do any other cryptocurrency, the only difference lies on the fact that price of BitUSD cannot go below one USD when the price of other cryptocurrencies could reach zero. We have taken USD as an exemple, but any asset could be chosen to serve as underlying.

INNOVATION

Bitshares has brought so many innovations that it is sometimes difficult to determine what is its the core product. Even if Bitshares has been criticized for its dispersion, it is important to say that, the decentralised exchange, its DAC structure and the DPOS consensus method are working and get improved every years.

BUSINESS MODEL

Most of the income of Bistshares comes from the fees that are applied on the exchange for each transactions. It also comes from the different products that are sold on the exchange such as the Smartcoins and shares of the DAC. All the tokens retained before the launch of the platform also need to be taken into account.

THE TEAM

Daniel Larimer – Founder

Charles Hoskinson – Co-Founder (he left to join Ethereum)

Stan Larimer – developer and writer of the Whitepaper.

![Ledger Nano S review – The Safe of the futur [2020] Ledger Nano S avis](https://www.blockchains-expert.com/wp-content/uploads/2019/10/Ledger-218x150.jpg)

![Binance review: all you need to know [2020] binance review](https://www.blockchains-expert.com/wp-content/uploads/2019/09/binance-218x150.jpg)