PART I – THE DIFFERENCES WITH THE TRADITIONAL MODEL

Despite all the noise around cryptocurrencies, the medias too often evade the real interest that these projects bring: a new business model. The organization of each of these projects is very different from what we have known up to now. All our corporate models and securities valuation are not applicable to these new entities and their tokens.

This articles series aims to understand what are the differences between these two models, “centralized” vs “decentralized”. The articles will be distributed as follows:

Part I – The differences with the traditional model.

Part II – How to assess ecosystems that issue Currency tokens?

Part III – How to assess the ecosystems that issue Platform & Utility tokens?

A CRYPTOCURRENCY IS NOT A COMPANY BUT AN ECOSYSTEM

First, it is important to describe what each of these projects really is.

Each of these projects based on a blockchain can be defined as a standalone ecosystem which is created around a new protocol, animated by a community of developers and users, who are paid with tokens created by the protocol for their participation in the development of the project. Let’s break down this sentence to analyze each of its components.

By protocol we mean a computer program which brings together all the operational rules of an application. All cryptocurrencies are protocols. The Bitcoin Protocol is the program which brings together all the operation rules of the bitcoin. The protocol determines the rules of mining, the conditions of validation of transactions, the remuneration of miners, the difficulty of the “Proof of work”. Each of these cryptocurrency is based on a protocol that defines its operation and also the creation of the tokens as well as their interaction with the rest of the application.

It is important to note that these protocols can be constructed on top of other protocols. There are indeed many protocols that are built on top of the Bitcoin Protocol to benefit from a decentralized and secured structure without having to manage the cryptoeconomy and network parts that we describe below.

Protocols can also be included in the Smart Contracts and benefit in the same manner from the features of the blockchain on which they are hosted. It is precisely the type of service that Ethereum offers by proving developers with the environment necessary to develop protocols or decentralized applications.

Ethereum goes further than the bitcoin in that it allows developers to take advantage of a decentralised environment based on a blockchain (including protocols for crypto-economy and network), but also of a virtual machine able to execute commands more or less complex from the contracts stored on the blockchain. This Ethereum Virtual Machine is composed of all the members of the network Ethereum.

TOKENS ARE NOT A SHARE OF A PROTOCOL

When you hold a cryptocurrency token, you do not have a share of the Protocol which created it, as you would when you own the shares of a traditional company. A protocol is inherently decentralized and belongs to each members of the network. For example, if you owned 51% of the bitcoins currently in circulation, you would not have more influence on the evolution of the network or the changes to the Protocol than if you had 0.1%. It would be different if you held 51% of the mining capacity (hashing power) since in theory you would have the power to choose the blocks that should be added or not to blockchain.

In other words, a cryptocurrency is a certificate used to exchange the perceived value of the protocol on cryptocurrencies exchanges. This business model cannot be compared to traditional companies where securities give you a right to dividends proportional to the profits made by the company. The incomes generated by these protocols are of very different nature and are created in the form of tokens to pay users who participated to the development of the network. It is important to remember that these tokens are generated by the Protocol from thin air.

These tokens gain value (or not) when they are traded on crypto-currencies exchanges, if purchasing demand is greater than number of tokens available. This demand is generated by the value created by the Protocol and the network by solving a particular problem. As will be describe in parts II and III of this article series, the value of tokens is influenced by many other factors that must be taken into account to determine their present and future value. In any case each protocol is created to solve problem more or less important:

Bitoin: instant transfer of value on the internet, regardless of distance or volumes.

Ripple: connect banking networks that are currently independent and do not communicate with each other’s easily.

Ethereum, Neo, Wave, Bitshares: provides a decentralized application development platform.

Siacoin, Storj, Filcoin, Madsafe: allows member of a network to access free memory space of the other members of the network in a secured and decentralized manner. All of these services have a perceived value that corresponds to the reality or not. Even if there is a significant part of speculation, this value is reflected in the resale price of the tokens on the cryptocurrencies Exchange.

DIFFERENT TYPES OF PROTOCOLS/TOKENS Many articles have been written to propose a classification of the tokens:

- William Mougayar offers a particularly interesting Utility Tokens analytical grid. After analyzing many ICO, he has identified 6 different roles that tokens can play.

- Alex Kruger considers that it is possible to organize token in accordance to whether they are native or not (as described below)

- Lou Kerner identifies three types of Tokens: the cryptocurrencies, Utility Tokens and Asset Tokens.

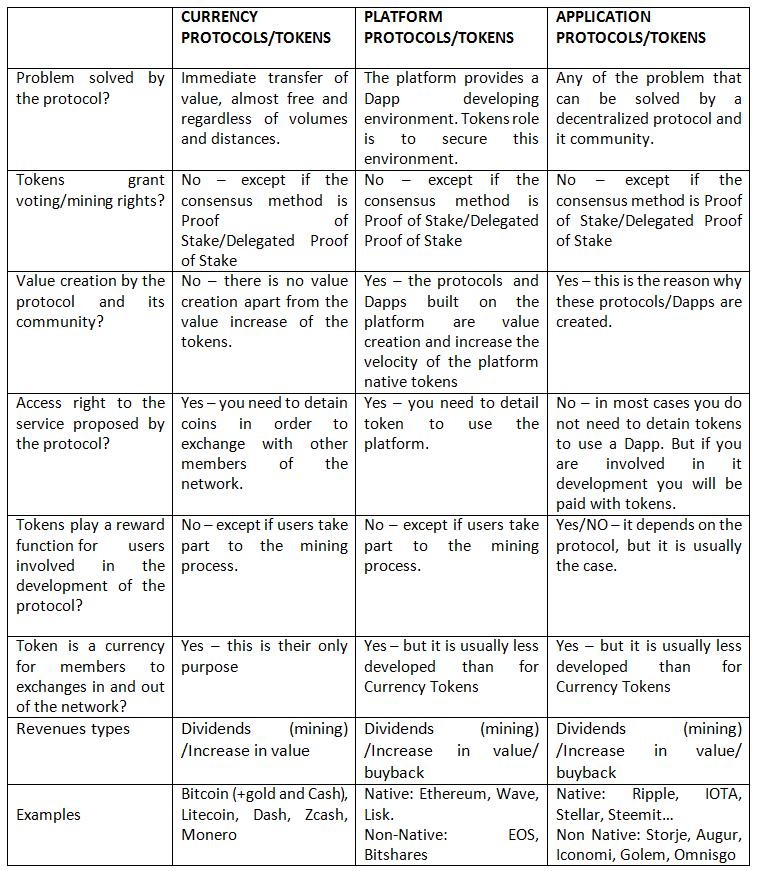

To simplify, we decided to classify the tokens in three categories:

– Currency Protocols/Tokens: Currency tokens are only used to transfer value among the members of the network and outside through exchanges of crypto-currencies. The most famous of them is the bitcoin. Other tokens have the same function but generally propose an improvement compared to the bitcoin: for example Litcoin adds transactions to the blockchain faster; Zcash, Monero, dash, focus on the anonymity of their users.

– Platform Protocols/Tokens: Platform tokens are issued by the protocols which purpose is to provide an environment for Dapps development. “Ethereum” is the most famous of these platforms and “Ether” is the token used by the network. There are other platforms such as “Lisk” dedicated to applications written in JavaScript, “EOS” for applications written in Webassembly, “Stratis” for applications in C# and “NEO” which is the Chinese clone of Ethereum.

– Application Protocols/Tokens (or utility tokens): These are the most common. The object of these tokens is always to connect users to a decentralized application, but the role of these tokens may be very different from one application to another.

We could also add the “asset Tokens”, which purpose is to represent a tangible asset or not, fungible or not, recorded on the blockchain. This type of token does not bring major innovation to the extent that this mechanism already exists under the name of “Securitization”. The innovation lies only on the fact that titles are registered on a blockchain.

It is important to note that each of these types of tokens can be divided into two sub-categories: “Natives Tokens” and “Non-Native Tokens”.

Indeed, an additional difference can be carried out tokens are issued by a protocol with a view to coordinate its operation or if the token coordinates the operation of a decentralised application (Dapp) based on an existing protocol. In this last case, one could say to simplify that the protocol (and therefore the native token) takes charge of the mechanical issues of a decentralized network: consensus between members of the network to add the blocks, validation of transactions, communication between the members of the network. The non-native token would only deal with the Dapp operations.

As stated by William Warren, the functions of protocols can be regrouped into two groups. On the one hand, the rules of the protocol which cover the issues of crypto-economy and on the other, the rules of the protocol which manage the interactivity of the network.

– The rules related to the crypto-economy: the word crypto-economy is composed of two words, cryptography and economy. It is therefore cryptographic rules designed to secure the network (private/public key, hashing , proof of work, Merkle tree…). Yet these cryptographic mechanisms are activated by the members of the network for a fee. The protocol also governs this economic part in defining to what extent the members are paid for their participation in the network. For instance in the bitcoin network, the protocol defines both the level of difficulty of the proof of the work and the number of tokens that will be allocated to minors for each block added to the blockchain.

– The rules related to the management of the network: these are all of the rules that govern the communication between the different members of the network, such as sending transactions or communications of the proof of work by minors to the rest of the network for approval.

Then there are the many applicationd (decentralised applications or DAPP) which are built on top of these protocols for developers to concentrate on the problem that they wish to resolve while benefiting from the advantage of a decentralized network and delegating the logistics.

These Dapp also issue their tokens so that users can interact with them. These are the non-native tokens. Thus the two types of tokens are necessary for the operation of the DAPP, but do not have the same function.

This is for example the case of Dapps which are created on top of the Ethereum protocol (Storje, augur, Iconomi, Golem, Omnisgo…). They actually benefit from the development environment and the blockchain maintained by Ethereum. These Dapps are Smart Contracts i.e. programs that are recorded on the Ethereum blockchain. These programs manage the operation of the application and the way we can interact with it. The interaction is done through tokens which are themselves created by the Smart Contract. To learn more about the operation of Ethereum I invite you to read our article “Ethereum: The computer world”.

At the same time, the developers of the DAPP will use Ethers (Native token of the Ethereum blockchain) to store the Smart contract including the program of the DAPP on the blockchain and interact with it. But this Smart Contract will also issue its own tokens (token of non-native).

On the site Coinmarketcap.com, these two categories of tokens are quite identifiable by selecting “Coins” or “Tokens” at the top of the list of all tokens. The “Coins” correspond to what we have called the “Native tokens”, that is to say according to the definition of the website,” crypto-currencies which can operate independently” since they have their own blockchain.

The “Tokens” tokens (non-native) By contrast, is a “crypto-currency which is dependent on another crypto-currency as platform for work”.

You can also see that the 10 tokens benefiting from the “marketcap “the most important, are all of the corners and non-tokens, but it is a point on which we will come back to in the Part II and III of this article series.

DIFFERENT TYPES OF REVENU

The revenues provided by tokens are also of a different nature from those of the traditional securities.

The revenues generated by a token can be very varied and depend on the problem that attempts to resolve the protocol. We can however identify three modes of recurring compensation:

– a dividend

– a buyback

– an increase in the value

1 – DIVIDENDS

A token generates dividends where the members of the network are paid for their participation in the network. This participation may take several forms:

– The provision of resources: users of a network are paid for lending to the network resources which belong to them. These resources can be very varied:

- It may be the calculation capacity of a computer installation: Mining is the most common example. In other words, the miners of a network (bitcoin for instance) put at the disposal of the network their own computer installation calculation capabilities (hashing power), to complete the consensus mechanism (proof of work for example) and add the transactions of the network on the blockchain. Minors are therefore paid for their contribution to the network, in bitcoin created by the Protocol (and costs attached to transactions). Mining is also the only mechanism for the creation of bitcoin.

- It can also be memory space: In the case of SIA, Storj, Filcoin, Madsafe, users are paid to let other members of the network dispose of a part of the memory of their computer installation.

– By the production of content: Steemit is a good example. It is the first social media on which members are paid for posting articles and comments. Each member of Steemit vote for the articles that he reads and generates a remuneration for the writer that is proportional to its level of involvement in the network. So as soon as you vote for an article, the protocol automatically grants remuneration. The more Steem token (token issued by the Protocol Steemit) you possess, the more your vote will make a significant remuneration to the author of the article.

The number of person who votes for your article is important, because the more vote you receive the more money you receive. It is not rare to see writer be paid $500 for their articles.

Steemit is an excellent example of the way the Internet will evolve in the coming years. At the moment we provide the few platforms that we use (Facebook, Twitter, Intagram…) with all our content and personal data for free. But this period will end pretty soon. With the decentralized protocols and the new social media platforms, you no longer need to give your personal data and you are paid for the content that you add. This formula will apply very soon to all platforms who wish to survive the blockchain.

For example, I would not be surprised to see websites such as Tripadvisor compensate its users with travel tokens for any comments added on the hotels that you have visited. These tokens would grant you free nights in other hotels.

2 – TOKEN REDEMPTION:

In cryptoassets universe, token redemption does not take the same form as securities redemption that we are currently experiencing. The redemption is carried out in an indirect manner by the destruction of tokens.

It is indeed important to understand that in a network where the number of token is limited, destroying a certain number of tokens increases the value of the remaining tokens.

Bitshares consensus mechanism (delegated Proof of stake), for example, allows “witnesses” wishing to be elected to propose to the members of the network of “burn” (“burn”) a part of tokens that they will receive from the protocol as a reward for their work of “mintage” (we talk about “mintage” for proof of stake mechanism and not of “mining”, but the meaning is the same). Instead of getting richer, they therefore propose to remove these tokens from the network and thus to increase the value of other tokens.

3 – THE INCREASE OF VALUE

This is a common component of any investment, yet it is important to understand how and why a token gets value.

We respond to this question in Part II dedicated to the valuation of Crypto Tokens and Part III dedicated to the valuation of Platform and Utility Tokens.

The table below is a summary of what has been discussed above and should give you a better understanding of the main differences between the existing tokens:

IF YOU ENJOYED THIS ARTICLE, PLEASE DO NOT HESITATE TO LIKE IT OR SHARE IT!!

Follow me on Social media

![Ledger Nano S review – The Safe of the futur [2020] Ledger Nano S avis](https://www.blockchains-expert.com/wp-content/uploads/2019/10/Ledger-218x150.jpg)

![Binance review: all you need to know [2020] binance review](https://www.blockchains-expert.com/wp-content/uploads/2019/09/binance-218x150.jpg)

![Kraken review: all you need to know [updated 2020]](https://www.blockchains-expert.com/wp-content/uploads/2020/01/kraken-review-2019-4-780x405-100x70.png)

![Ledger Nano S review – The Safe of the futur [2020] Ledger Nano S avis](https://www.blockchains-expert.com/wp-content/uploads/2019/10/Ledger-100x70.jpg)

![Binance review: all you need to know [2020] binance review](https://www.blockchains-expert.com/wp-content/uploads/2019/09/binance-100x70.jpg)

![local bitcoins review – Read this before using [Full Guide 2020] LocalBitcoin avis](https://www.blockchains-expert.com/wp-content/uploads/2019/05/LocalBitcoins-100x70.jpg)

![Bitcoin Value in Dollar – how to analyze and predict it? [Ultimate guide 2020] Bitcoin gold](https://www.blockchains-expert.com/wp-content/uploads/2019/03/Bitcoin-gold-100x70.jpg)